Guaranteed Asset Protection insurance more commonly known as GAP insurance is an insurance product that helps you cover any shortfall between your insurance provider’s payout and your remaining payments on a finance agreement.

There are a number of different types of GAP insurance but if you are leasing a vehicle then it would be lease GAP insurance that you need.

Taking out a GAP policy can help reduce the worry for you at a stressful time for you.

In the unfortunate circumstances that your car is involved in an accident or fire and is damaged beyond economical repair or is stolen and unrecoverable then your vehicle insurer will pay out a sum for the vehicle value at the time that it is written off. This amount will take into account the age, condition and mileage on the vehicle.

Your finance company will also send you a settlement letter which will confirm the amount owed to them for the remainder of the lease rental payments.

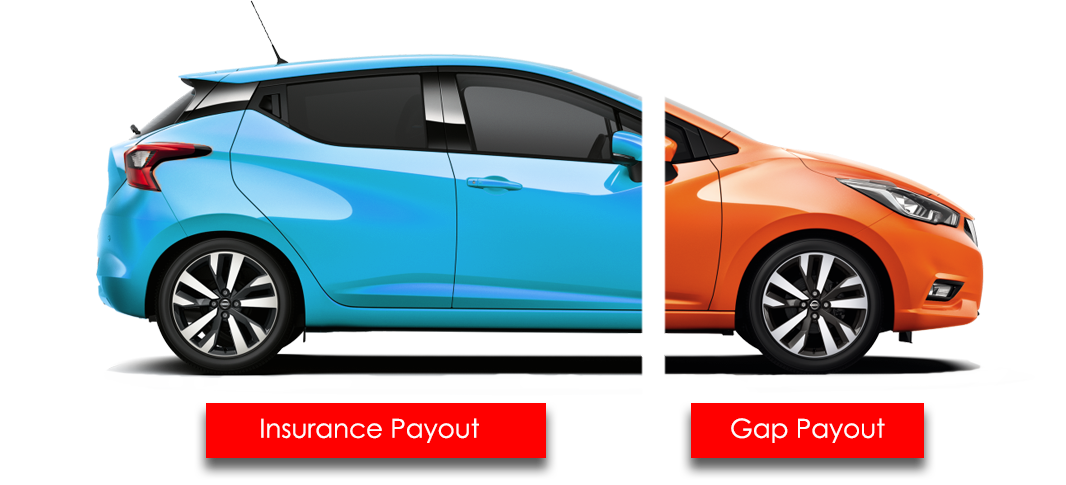

Where there is a gap between the amount that your insurance provider value the vehicle at and the amount the outstanding payments come to your GAP policy would then come into play. It should cover the difference between these two amounts that otherwise you would be expected to pay.

You will just need to contact your GAP provider if your car is written off to start a claims process. They will then be able to talk you through the process and advise you on what you need to do.

If your lease car is written off, let's say the insurance company has agreed to pay out £10,000 for the loss of the car, while the finance company gives you a settlement figure of £13,000. This then means there is a £3,000 'gap' which you can then claim for using your GAP insurance.

GAP insurance provides several benefits when leasing a car including:

1. Depreciation Protection

GAP insurance safeguards against the depreciation of a leased car. If the vehicle is declared a total loss due to theft or an accident, your car insurance may only cover the current market value, which could be lower than the remaining lease balance. GAP insurance covers the difference, preventing you from bearing a significant financial burden.

2. Total Loss Coverage

In the event of a total loss, such as theft, accident, or natural disaster, GAP insurance bridges the gap between the insurance settlement and the outstanding lease balance. This means you won't have to pay out-of-pocket for remaining lease payments or negative equity resulting from the loss.

3. Financial Security

GAP insurance offers greater financial security by protecting you from unforeseen and potentially substantial expenses if your leased car is written off. It ensures you won't be held responsible for paying off a lease for a vehicle you no longer possess.

4. Lease Flexibility

GAP insurance provides lease flexibility. You can confidently choose lease terms that suit your needs, such as shorter lease periods or higher mileage limits, without the worry of potential financial liabilities in case of a total loss.

5. Peace of Mind

You can drive your leased car with confidence, knowing that if an unfortunate event results in a total loss, you have coverage to handle the financial obligations of the lease agreement.

When taking out GAP insurance there are a few things you will need to take into consideration.

GAP insurance is separate from your standard comprehensive car insurance and works alongside this not instead of it. You will still need to insure the vehicle if you take out a GAP policy.

The vehicle will need to be maintained per your manufacturer’s service schedule.

Please also be aware that your GAP insurance provided may not cover the below:

GAP FAQs:

No, it is not compulsory to take out GAP insurance on a lease with Xcite Car Leasing. It is up to you if you would like to take out a GAP policy.

Most providers will let you take out GAP insurance at any point up to delivery of your lease vehicle.

The cost of GAP insurance varies between suppliers if you are looking at different policies across the market.

It will also depend on the length of your lease agreement, coverage for a four year lease will be more expensive than cover for a two year lease.

Once the lease term expires or the lessee terminates the lease early, the coverage period for GAP insurance typically comes to an end. Furthermore, if you have fully paid off the remaining balance on your lease or the actual cash value (ACV) of the vehicle is equal to or greater than the lease balance, you may have the option to cancel the GAP insurance coverage since it is no longer necessary.

GAP insurance is generally non-transferable in the majority of cases. When you transfer your lease to another person, the GAP insurance coverage does not usually transfer along with it. If the new lessee wishes to have GAP insurance, they will likely need to purchase their own policy separately.

While GAP insurance provides coverage for most scenarios where your car is declared a total loss or stolen, there are specific exceptions to be aware of. Your GAP insurance coverage may be invalidated under the following circumstances:

It's important to carefully review the terms and conditions of your GAP insurance policy to understand the specific situations in which coverage may be excluded. If you have any doubts or questions, reach out to us for clarification.

Check out one of our helpful guides or our explaination of leasing to get all your questions answered.

You can unsubscribe at any time